Flexible terms, low rates, and knowing what you really need are our strengths when it comes to Auto Loans.

Apply Online

Flexible repayment terms

No prepayment penalties

Easy to pay online and set-up automatic payments

Some of the best local and national rates!

Quick application process

Certified credit counselors available

Apply for your auto loan directly at the dealership through our AutoConnection® Program!

We partner with over 100 local dealerships to allow you to conveniently get an auto loan with us for your vehicle purchase without having to leave the dealership. Our AutoConnection® Program guarantees the same great finance rate and terms whether you apply directly with us or through our dealer partners.

Click Here to find a current list of our dealerships that work with our AutoConnection® Team!

Purchasing a Car from a Private Seller?

Many financial institutions charge a higher finance rate when you purchase from a private seller versus a dealership. With CFCU, the rate is the same.

Refinance

If you have an auto loan with another financial institution, we may be able to beat your current auto loan rate and save you money. You will need to know your payoff amount when you apply for a refinance.

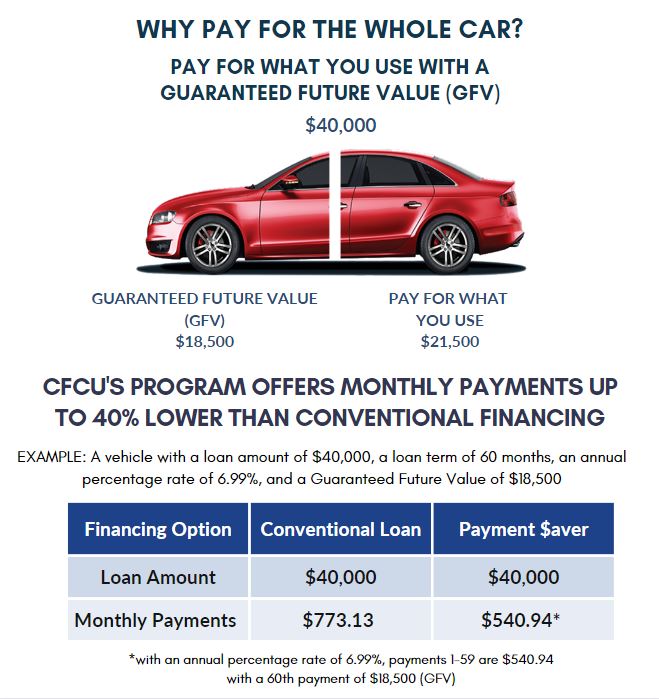

Payment $aver Program

Payment $aver is a low-payment vehicle loan that combines the best features of conventional financing along with the benefits of leasing! Like a lease, Payment $aver offers payments significantly lower than conventional vehicle loans when you purchase a new or used vehicle. Yet, unlike leasing, with Payment $aver you own the vehicle and receive all of the flexibility and benefits of vehicle ownership!

FEATURES:

- All vehicles up to five-years old qualify

- All qualifying vehicles can be financed for up to 72 months

- No early payoff penalty

- 100% financing with NO MONEY DOWN

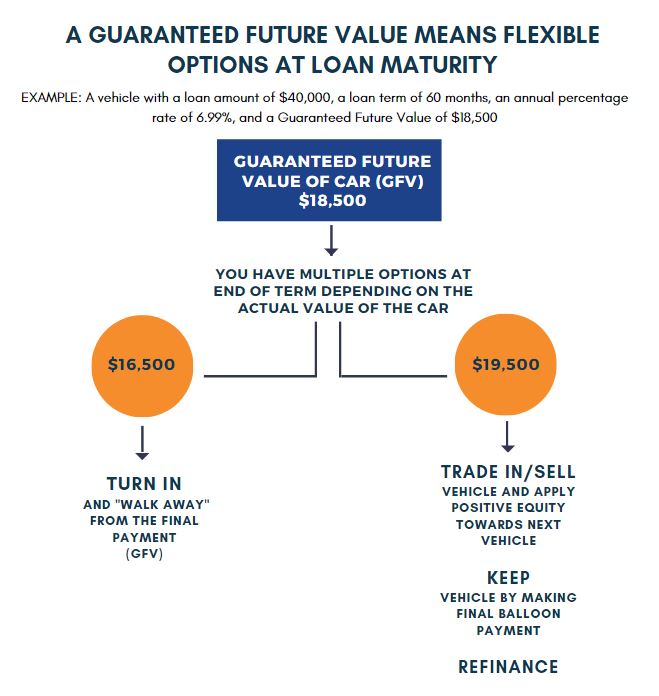

- The option to sell, trade, or return your vehicle at maturity and simply “Walk-away!”

- Annual mileage options of 7,500, 10,000, 12,000, 15,000, and 18,000

- If you love your vehicle at maturity, you can payoff or finance the residual value and keep it!

For more information call us at 607-257-8500 or toll free at 800-428-8340 or stop into any branch.

* Mileage limits selected, excess mileage, and vehicle condition may affect residual value. A vehicle disposition fee for turn-in at maturity applies. Rates and terms are based on borrower creditworthiness. Loans subject to credit approval and rates and terms subject to change without notice. Recreation vehicles and motorcycles do not qualify for payment saver.

Shopping at the dealership? Apply for your auto loan through our AutoConnection® Program

One-Time Rate Adjustment

As a credit improvement incentive, you can request a rate adjustment after 6 on-time monthly payments. No application is required.

Give us a call or visit a branch to see if you qualify.

*Rate adjustment is not guaranteed and is based on creditworthiness at the time of rate adjustment application. Creditworthiness is based on a credit report review; credit scores are determined by the credit reporting agency. Rate adjustment is effective as of the application approval date through the remainder of the loan. CFCU will not adjust the rate higher if your credit worsens. Rate adjustment can only be requested once per loan.

We offer auto loans in Ithaca, Cortland, Waterloo, North Syracuse, East Syracuse and more.

Insurance

CFCU Insurance Services

Learn how much we can save you on insurance rates.

- Auto Insurance

Receive multiple quotes to choose from. - Guaranteed Asset Protection (GAP) Coverage

Is a non-insurance product and is made available via a loan/lease deficiency waiver that covers the "gap" between the vehicle's value and the amount you still owe. Essentially, GAP covers the difference between your primary carrier's insurance settlement and the payoff of your loan or lease, less delinquent payments, late charges, refundable service warranty contracts, and other insurance-related charges, less your deductible. - Mechanical Repair Coverage

Is coverage that can help limit the cost of any covered breakdowns. You pay only the applicable deductible. Learn More at www.cunamutual.com/mrcdetails or give us a call. - Borrower Security

This protection could cancel your loan balance or payments up to the contract maximums. Purchasing protection is voluntary and won't affect your loan approval. It's simple to apply. Ask us about eligibility, conditions, or exclusions*. *Insurance products are not insured by NCUA or any Federal Government Agency; are not a deposit of, or guaranteed by CFCU Community Credit Union or any affiliated entity; and may lose value. Any insurance required as a condition of the extension of credit by CFCU Community Credit Union need not be purchased from our Agency but may, without affecting the approval of the application for an extension of credit, be purchased from an agent or insurance company of the member’s choosing.

*Proof of insurance is required for all collateralized loans with a maximum insurance deductible of $1,000 with proof of comprehensive and collision coverage.